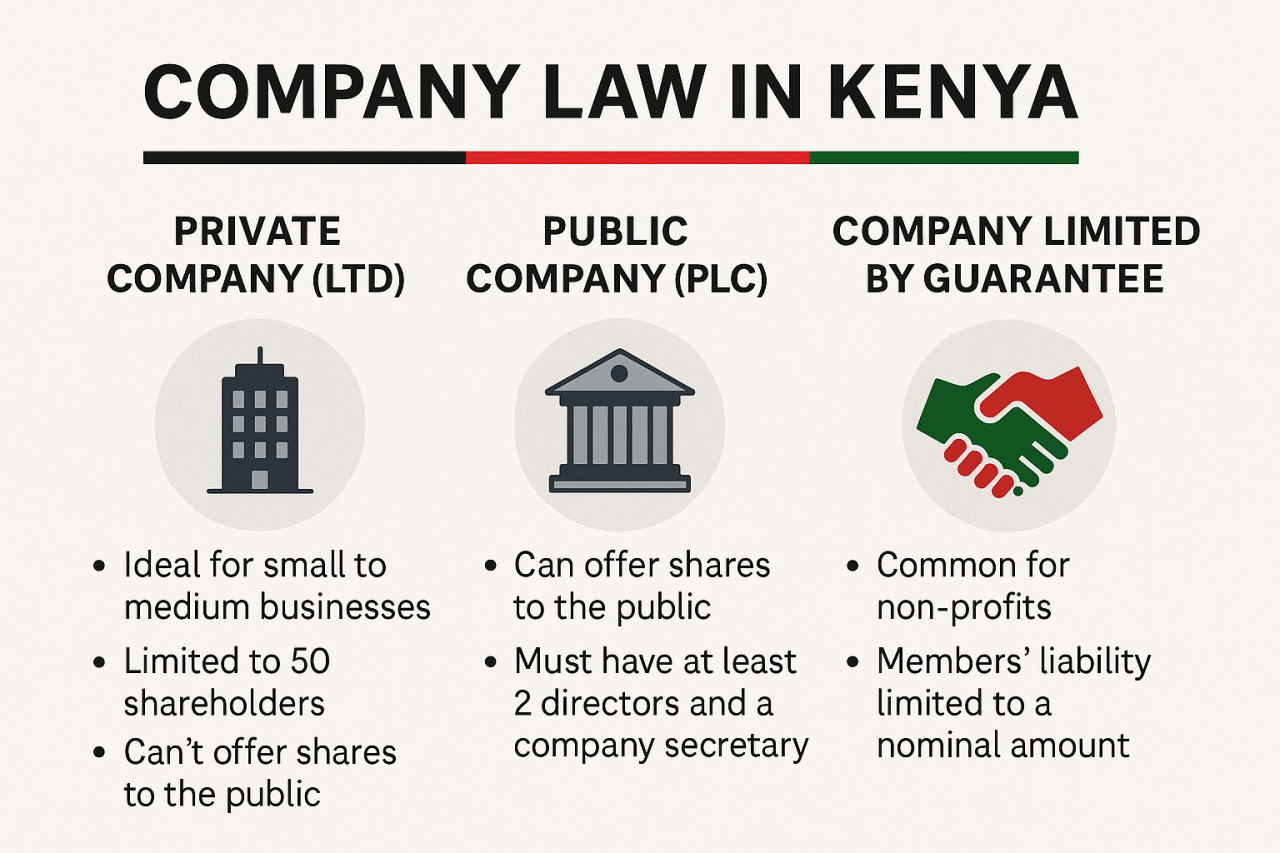

Type of companies under the Kenyan Companies Act 2015

Under Kenyan law, companies can be classified into two main categories:

-

Limited Companies

-

Unlimited Companies

The key difference lies in the extent of liability the members (shareholders or guarantors) bear for the company’s debts.

1. Unlimited Companies

In an unlimited company, members have no limit to their liability. They are jointly and personally responsible for paying all debts if the company is wound up.

While rare in modern practice, unlimited companies may be suitable in situations where:

-

The risk of insolvency is minimal.

-

The business operates in a sector where limited liability is discouraged.

-

Financial secrecy is a priority.

-

Potential reductions in share capital are anticipated.

Legal Position:

-

Companies Act (Cap 486) permits incorporation of both public and private unlimited companies, as well as the re-registration of an unlimited company as a limited company.

-

Companies Act, 2015 allows only unlimited private companies, with procedures in place to convert between limited and unlimited status.

2. Limited Companies

A limited company separates the entrepreneur’s personal assets from the company’s finances. Shareholders are only liable for company debts up to the amount they have invested.

There are two main forms:

-

Companies Limited by Shares

-

Companies Limited by Guarantee

2.1 Companies Limited by Shares

The liability of members is limited to the unpaid amount on their shares.

Two main sub-categories:

-

Public Companies Limited by Shares

-

Private Companies Limited by Shares

2. Companies Limited by Guarantee

A company limited by guarantee has members who agree to contribute a fixed sum towards the company’s debts if it is wound up.

Best suited for:

-

Non-profit organisations

-

Trade or professional associations

-

Charities

-

Clubs funded by membership subscriptions

Advantages:

-

No share transfers when members change

-

Limited liability without share capital (under Companies Act, 2015)

Regulatory Note:

Under current administrative practice, companies limited by guarantee require clearance from the National Intelligence Service (NIS) before incorporation. This process can be lengthy and uncertain, resulting in very few such companies being registered.

Choosing the Right Structure

When deciding between limited by shares, limited by guarantee, or unlimited, consider:

-

Your risk tolerance

-

Capital raising needs

-

Privacy requirements

-

Whether you need a for-profit or non-profit structure

-

Long-term exit or restructuring plans